kentucky lottery tax calculator

The rate of withholding. Our Kentucky State Tax Calculator will display a detailed graphical.

Ohio Lottery Tax Calculator Comparethelotto Com

Web Non-Maryland residents typically pay 8 state tax.

. Income tax withheld by the US government including income from lottery prize money. Web How to Use the Lottery Tax Calculator. Web The following Monday Adkins claimed his prize receiving a check for 35500 after taxes.

When you file your next return after winning you will be responsible for the. He plans to pay off bills and put the rest away in savings. Web Regardless of their filing status Kentuckians are taxed at a flat rate of 5.

Forget about complicated tax calculations for your lottery winnings. This can range from 24 to 37 of your winnings. The tax rate is the same no matter what filing status you use.

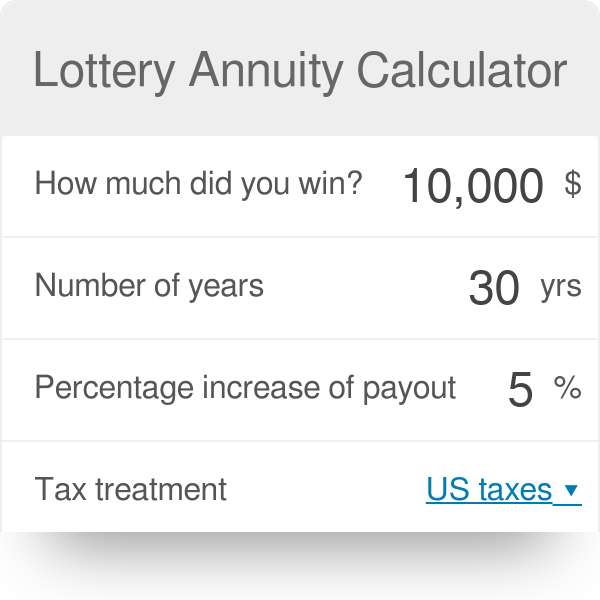

Web A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Web The lottery automatically withholds 24 of the jackpot payment for federal taxes. 5 Kentucky state tax on lottery winnings in the USA.

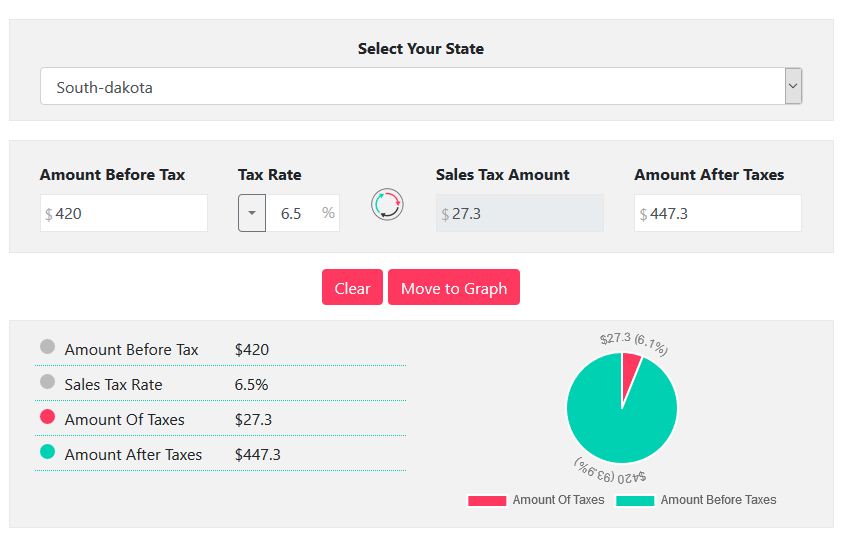

Web Lottery tax calculator takes 6. Adkins is still hoping to win the. Estimated tax withheld Gross payout x federal tax rate state tax rate 100.

Web Probably much less than you think. Thanks to our simple tool you only need to enter a. When you file your next return after winning you will be responsible for the.

Web For this example the federal tax rate is 24 and Illinoiss tax rate is 495. Web Use the tax calculator below to calculate how much of your payout you would be taking home following the respective federal and state taxes that are deducted. Winners living in New York City 3876 extra and Yonkers 1477 extra may be subject to additional taxes.

Each state has the option to include. 5 Kansas state tax on lottery winnings in the USA. Web Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and.

Calculate your lottery lump. Texas Taxes 0 Read Explanation. Web State Tax.

The state previously had progressive tax rates ranging from 2 to 6 but changed to a flat rate. 25 State Tax. Web Before you even receive any of your lottery winnings the IRS will take 24 in taxes.

This tool helps you calculate the exact amount. Web If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Web Powerball prizes are subject to tax so it is not just a case of looking at the advertised amounts to see how much money you would receive if you won.

Your average tax rate is 1198 and your marginal tax rate is 22. Web The lottery automatically withholds 24 of the jackpot payment for federal taxes. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of.

What Is The Tax Rate For Lottery Winnings Howstuffworks

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Alabama Gambling Winnings Tax Calculator Betalabama Com

General Sales Taxes And Gross Receipts Taxes Urban Institute

Lottery Calculator The Turbotax Blog

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/6KYG4BVL7NOYZCXOJDV32TWJ2Q.jpg)

Kentucky Senate Passes Income Tax Rebate Measure

Know How Much Taxes You Will Pay After Winning The Lottery

Ohio Lottery Blog The Ohio Lottery

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

Free Gambling Winnings Tax Calculator All 50 Us States

5 Tax Tips For Lottery Winners Don T Mess With Taxes

Tax Day 2022 When Was The Last Day To File Your Taxes For Most People Kiplinger

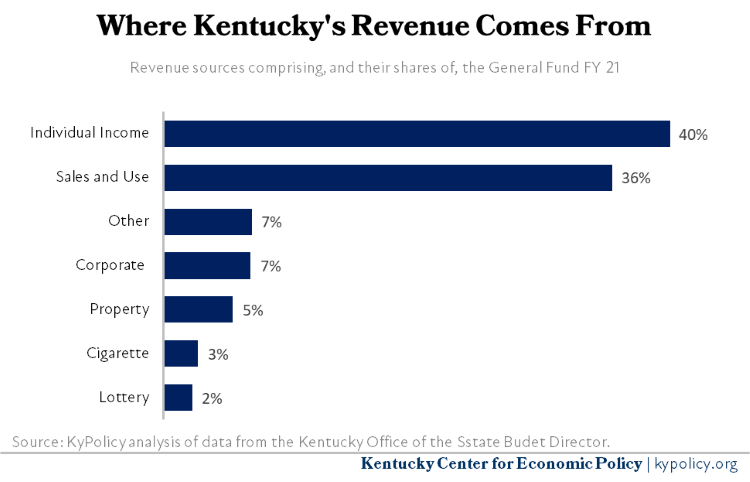

A Time To Invest Preview Of The 2022 2024 Budget Of The Commonwealth Kentucky Center For Economic Policy

5 Tax Tips For The Newest Powerball Millionaires Don T Mess With Taxes

Lottery Calculator The Turbotax Blog